PLife REIT is one of the largest listed healthcare REITs in Asia by asset size. Its mandate is to invest in incomeproducing real estate and/or healthcare-related assets primarily used for healthcare and/or healthcare-related purposes in Singapore and Asia.

o 4Q11 (FY11) revenue $22.8mn ($87.8mn), NPI $20.8mn ($80.3mn), distributable income $14.9m ($58.1mn)

o DPU for 4Q11 (FY11) at 2.47 cents (9.60 cents)

o Incorporate 95% payout ratio from 2012 to2016

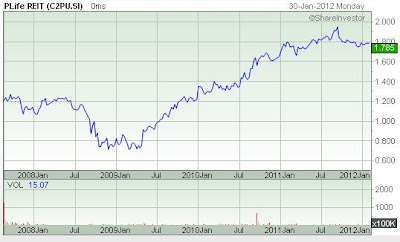

o Upgrade to ACCUMULATE though with a lowered target price of $1.880

What is the news?

9.2% from 8.79 cents to 9.60 cents. The key performance indicators – gross revenue, net property income, and distributable income for FY11, together rose in the range of 9.1%-9.6% to $87.8mn, $80.3mn and $58.1mn respectively compared to the preceding year.

How do we view this?

DPU was largely in-line with our expectations, amounting to 99.5% of our full year estimates. The increase in DPU was mainly due to:

(1) yield-accretive acquisitions made in 2010/11,

(2) upward rental revision of Singapore properties and

(3) lower financing costs.

Investment Actions?

High inflationary environment has prompted us to raise our CPI rental review assumption for FY12 from 2.5% to 6% with respect to Singapore properties. While the retention distributable income to take effect in FY12 will net off the gains in the rental growth. FY12 DPU is expected to dip first before heading north in the following years. We rollover our estimates to FY16 and arrive a lower target price of $1.88. Nevertheless, it would be good to accumulate PLife REIT against the backdrop of global uncertainties and high inflationary environment given its resilient and sustainable model.

DPU remained resilient and soared throughout FY11

DPU had trended higher throughout the quarters in FY11, with the exception in 1Q11. The blip was due to the removal of management fee paid in units which has artificially inflated the DPU prior to 1Q11. With the full contribution from the acquisition of Fukufuku-kan in Jan 2011, DPU in 2Q11 improved to 2.37 cents. The higher rent from the Singapore hospital properties due to rental growth rate of 5.3% for the fifth year lease term commencing 23 August 2011, further boosted the DPU to 2.40 cents in 3Q11 and 2.47 cents in 4Q11. For the whole of FY11, DPU grew 9.2%, much lower than the 13.6% growth in FY10 as more properties were acquired in 2009/10.

Retention of distributable income

The management has announced that a portion of the distributable income will be retained to finance recurring capital expenditure needs of its existing properties through operating cashflow with effect from FY12. It was understood that approximately $3mn will be retained for FY12. In this connection, we have assumed a payout ratio of 95.0% from 2012 to 2016. This action will reduce the REIT’s reliance on debt to fund its capital expenditure while DPU will decrease accordingly.

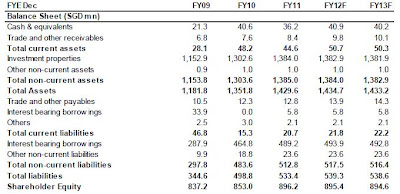

Healthy gearing of 34.8% as at 31 Dec 2011

Aggregate leverage was down from 36.6% in 3Q11 to 34.8% in 4Q11 as a result of revaluation gain of $46.5mn for total portfolio value. This leaves PLife REIT with ample debt headroom of $125.0mm and $266.4mn based on 40% and 45% gearing respectively.

Inflationary environment spurs organic rental growth for Singapore properties

Rent review mechanism for Singapore properties are based on CPI + 1% rental revision formula which is computed on a 12-month average basis from July to June of the following year. With the average CPI from July to December 2011 stood at 5.5%, we therefore presume 6% rental growth for the sixth year lease term.

Background:

Parkway Life REIT is established by Parkway Holdings to invest primarily in income-producing real estate and/or real estate-related assets in the Asia-Pacific region (including Singapore) that are used primarily for healthcare and/or healthcare-related purposes (including but not limited to, hospitals, healthcare facilities and real estate and/or real estate assets used in connection with healthcare research, education, and the manufacture or storage of drugs, medicine and other healthcare goods and devices).

No comments:

Post a Comment