Target Price (SGD) 6.96

Company Overview

SGX Ltd operates as an integrated securities and derivatives exchange in Singapore. Security products include equities, bonds, exchange traded funds, warrants, and ADRs. Derivatives products include futures and options, structured warrants, and extended settlements.

- Securities Daily Average Value increased 19.3% q-q from a low base of $1.119 billion to $1.334 billion based on SGX figures.

- Derivatives Daily Average Volume disappoint with - 3.8% q-q contraction to 0.307 million contracts. Revenue expected to be higher due to increase in Asiaclear OTC activities, while Open Interest also increased significantly.

- Maintain Neutral call, with a revised Target price of S$6.96 based on an unchanged Price Earnings ratio of 24.0X.

What is the news?

SGX Ltd will be announcing its 1Q13 results on 18 Oct 2012. During the quarter, SDAV improved likely due to the FNN/ APB transactions, listing of a few attractive counters, and further boosted by market’s expectation and announcement of Quantitative Easing 3. DDAV however disappoints with a -3.8% q-q contraction to 0.307 million contracts.

How do we view this?

We expect Securities Revenue to increase q-q due to the higher SDAV. Derivatives revenue is also expected to increase due higher volume of Asiaclear OTC trades, and higher interest income on margin holdings resulting from the significant increase in Open Interest.

Looking ahead, although the increase in trading activities from the FNN/ APB events are non-recurring, we expect SDAV for FY13 to maintain within its current range due to further increase in attractive counters such as the upcoming Religare Health Trust IPO, and potential further market stimulus encouraging trading activities.

Investment Actions?

Although current dividend yields remain attractive at approximately 3.9%, it may take time before security trading values increase significantly. SGX’s share price is also currently trading above its 5-year historical Trailing Twelve Months (TTM) PE, and offer limited upward potential. We adjust our forecast to reflect the higher SDAV, listing revenue and Open Interest, increasing FY13 EPS forecast by 2.5%. We maintain our Neutral call, with a revised Target price of S$6.96 based on an unchanged Price Earnings ratio of 24.0X.

Securities trading value up 19.3% q-q in 1Q13

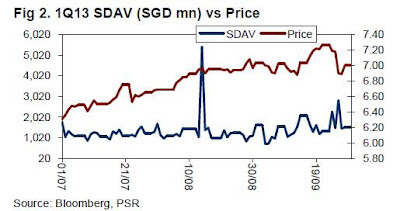

Securities Daily Average Value (SDAV) rebounded strongly in 1Q13 from a low base at 19.3% q-q to S$1.334 billion. This however included non-recurring amounts from the sale of OCBC’s and GE’s share in FNN and APB on 14 Aug 12, amounting to S$3.22 billion. This contributed to the sharp spike in SDAV as observed in Fig 2 below. Further purchases of APB and FNN shares by Heineken, ThaiBev and speculative investors also contributed significant trading activities during the quarter.

A few attractive counters were also introduced this quarter. This includes the IPOs of Ascendas Hospitality Trust and Far East Hospitality Trust, with a market capitalization of S$707 million and S$1.5 billion respectively, and the listing of IHH Healthcare Berhad, which is dual-listed on Bursa Malaysia and SGX, with an estimated market capitalization of S$9 billion. The introduction of these new listings likely improved market interest and trading activities.

SDAV also received a boost from the announcement of Quantitative Easing 3 by the US Fed on 13 Sep 12. Based on Bloomberg data, trading was significantly higher after the announcement, as seen from the spikes on the right side of Fig 2 above.

With the q-q increase in SDAV, we expect an increase in Securities revenue. We however expect a y-y decline in Securities revenue due to a -15.1% y-y decline in SDAV.

Looking ahead, while the increase in trading activities from the FNN and APB saga is non-recurring, we expect SDAV for FY13 to maintain within its current range due to further increase in attractive counters such as the upcoming Religare Health Trust IPO, and potential further market stimulus encouraging trading activities. However, we do not expect significant increase in trading activities in the next few quarters due to the continued uncertainty in the macroeconomic environment.

Derivatives volume disappoint but revenue to improve

Futures and Options Daily Trading Volume decreased -3.8% q-q, -4.8% y-y to 0.307 million contracts. While Total Options Trading Volume was up 76.4% to 1.36 million contracts during the quarter, Total Futures Trading volume was down - 5.1% q-q to 18.0 million contracts due largely to a drop in Nikkei 225 Index Futures. On a positive note, FTSE China A50 Index Futures continue to grow strongly, while we expect to see higher volumes for the MSCI Indonesia Index Futures with SGX obtaining approval for US investors to directly trade the Index Futures. Total Options Trading Volume was up due to higher activities for the Nikkei 225 Index Options, and the SGX S&P CNX Nifty Index Options.

We however expect a q-q increase in Derivative revenue due to higher volume of Asiaclear OTC trades, and higher interest income on margin holdings resulting from the increase in Open Interest. Asiaclear OTC volume increased 91.2% due to a sharp increase in OTC Iron Ore Swap as SGX establishes itself as the trading hub for Iron Ore Swaps.

Other revenue

We expect listing revenue to increase q-q in 1Q13 due to the large IPOs and IHH listing this quarter, while funds raised through Bonds issuance also increased 44.2% to S$52.5 billion. Corporate actions and other revenue are however expected to decline q-q due to seasonality changes arising from more corporate actions occurring in Mar-Jun. Expenses are expected to increase marginally q-q, in line with the expected q-q increase in revenue.

No comments:

Post a Comment