News and information of Singapore stock market. Chart with Support and Resistance. A blog to force myself to learn.

Oct 8, 2012

Sound Global a Cheaper China Water Industry Play

Company background. Sound Global is one of the leading one-stop integrated water and wastewater treatment solutions providers in the PRC. Its services cover the full value chain of water and wastewater treatment, including the design and construction as well as operation and maintenance of water and wastewater treatment facilities, and the manufacture of water and wastewater treatment equipment.

A first mover in a CNY430b market. Water treatment investments are set to double in the 12th Five Year Plan Period (2011-2015) to CNY430b in an effort to improve China’s wastewater treatment rate to 85% by 2015, from 77% currently. Commercialisation and privatisation of the Chinese water treatment market is also a long-term trend. With over 20 years of experience, Sound Global has become one of the leading one-stop integrated wastewater treatment solution providers in China, with a respectable market share.

Key revenue drivers. In our view, Sound Global’s revenue will be supported by:

1) continuous order wins thanks to a long-term relationship with the government, and

2) more BOT projects entering their collection period.

A hike in water tariffs in China will also have positive effect on revenue.

Margins likely to fall. Although we are positive on Sound Global’s revenue outlook, its high net margin of the past few years would be very hard to maintain, in our view. Recent high-cost borrowing will weigh on the company’s net margin for the next few years, assuming it does not redeem the senior notes before maturity.

Trading at large discount to peers. Sound Global is trading at a

large discount to its peers (6.7x FY12PE based on consensus vs average of 12.8x for HK-listed peers and Hyflux’s 16.7x). We currently do not have a rating and target price on Sound Global. However, we think the deep discount may not be justified given Sound Global’s comparable net margin and higher-than-peers ROE. Sound Global is worth considering if investors are looking for cheaper alternatives.

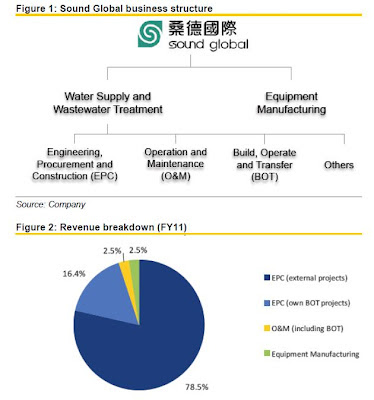

Business sectors

1) Water supply and wastewater treatment

- EPC – provision of turnkey services for the design, construction and installation of water or wastewater treatment facilities;

- O&M – operation and maintenance of existing water or wastewater treatment facilities for an agreed period and monthly fee, providing stable recurring cash flows; and

- BOT – investment, design, construction and installation of water or wastewater treatment facilities, and the operation of these facilities once construction is completed.

2) Equipment manufacturing

Design and manufacture of standard and customised equipment for water and wastewater treatment through the group’s wholly-owned subsidiary, Hi-Standard.

Why do we highlight this stock?

In our view, Sound Global is a direct beneficiary of China’s much stricter wastewater treatment standards and increasing investment in this sector. Currently, more than half of its BOT (build-operate-transfer) projects are still under construction. Those projects will contribute to revenue once construction is completed over the next few years. Although net profit margins will affected by recent expensive fund raising, we think the steep discount of its share price relative to peers might be excessive given the company’s respectable profit margin and high ROE.

China’s 12th Five Year Plan (2011-2015)

Water treatment investments are set to double in the 12th Five Year Plan period (2011-2015) to CNY430b, in an effort to improve China’s wastewater treatment rate to 85% by 2015 from 77% currently. The overall market offers a wide spectrum of opportunities for wastewater treatment market participants.

In addition to its CNY430b investment, the government is also encouraging non-public finance in the sector. Commercialisation and privatisation of the Chinese water treatment market is a long-term trend. With over 20 years of experience, Sound Global has become one of the leading one-stop integrated wastewater treatment solution providers in China.

The water treatment industry in China is currently dominated by big international players like Veolia and Suez. However, local Chinese companies have been gaining more and more market share from foreign competitors. By our estimates, Sound Global now has around a 2% share of China’s wastewater treatment market.

Issue of USD150m 11.875% senior notes

In August this year, Sound Global issued USD150m 11.875% 5-yrs senior notes preparing for possible redemption of its 6% convertible bond in Sep 2012 (The put options on its convertible bonds came into effect on 15 Sept 2012, allowing bondholders to force the company to buy back the CBs at par). However only 30% of outstanding CBs (worth USD45.7m) were put back by bond holders in the end, much less than expected.

The notes issue and CB redemption was a negative for the company, in our view, because 1) replacing 6% CB with 11.875% senior notes increased the interest burden on the company, and 2) the CB overhang still remains, as only 30% of CBs were redeemed while existing CBs could still potentially result in EPS dilution of 13%.

Valuation

Sound Global is trading at large discount to peers (6.7x PER vs. an average of 12.8x for its HK-listed peers and Hyflux’s 16.7x). It is relatively low-key in terms of with public relations, and is underresearched by analysts.

We currently do not have a rating and target price on Sound Global. However we noted that Sound Global’s share price underperformed the peers this year and we think the steep discount may not be justified given Sound Global’s comparable net margin and higher-than-peers ROE. Sound Global is worth considering if investors are looking for cheaper alternatives. We believe a re-rating is possible if the company can increase its public exposure, and market confidence on S-chips returns.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment