News and information of Singapore stock market. Chart with Support and Resistance. A blog to force myself to learn.

Feb 14, 2012

ComfortDelGro have good end to a challenging year

Target Price S$1.66

FY11 earnings slightly surpassed our forecast and consensus expectations at 103% and 101% of FY respectively. We raise our FY12-13 EPS forecasts by 2%-4% and introduce FY14 EPS. Maintain Outperform with a higher TP, still based on DCF, 7.3% WACC.

Good end to a challenging year

CD ended FY11 on strong footing with earnings up 3% on broad-based revenue growth. We were pleasantly surprised by its final dividend of 3.3 cts, taking total FY11 dividends to 6 cts, above our 5.5 cts forecast. The group overcame a 20% jump in energy costs by keeping a tight control on all other operating expenses, helping to hold net profit margins steady.

Next stop: DTL

We are excited by the upcoming Downtown Line, which will increase CD’s market share of Singapore’s rail network. This appears the most lucrative long term growth avenue in Singapore given unprofitable bus operations and persistently high COE prices which are impeding the growth of taxi fleets. We do not think that start-up costs for DTL will dent margins significantly as these should be offset by improving rail margins.

Good defensive play

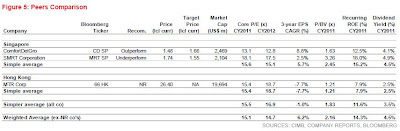

CD remains our top pick within Singapore’s land transport sector. First, its earnings outlook is superior to that of its peer SMRT, whose earnings are under siege by a spike in costs as a consequence of recent train breakdowns. Second, the group has demonstrated superiority in cost management. Third, it is a proxy to Singapore’s improving rail network connectivity. We continue to see value with this stock trading 0.8 standard deviations below its 4-year mean while offering dividend yields of 4%.

Company Overview

ComfortDelGro Corporation (CDG) is a land transport conglomerate with businesses across various business segments and geography. The bus and taxi businesses are the largest profit contributors for the Group.

- Net income increased 3.1%y-y

- Higher fuel expense, staff cost & depreciation expense resulted in a 0.4ppt decline in EBIT margin

- Final DPS of 3.30cents proposed

- Maintain Buy with revised TP of S$1.66

What is the news?

CDG announced a 6.4% and 3.1% increase in sales and net income for the year. However, margin pressures from higher fuel expense, staff cost and depreciation expense resulted in a 0.4ppt decline in EBIT margin. While revenue continue to increase sequentially, 4QFY11 net profits fell by 18%q-q, due to a c.S$10mn decline in operating profits for both the taxi and bus businesses. Final dividends of 3.30cents proposed, translating to a full year payout ratio of 53.3%.

How do we view this?

The results for the year were slightly weaker than expected. Key variances from our 4QFY11 estimates were 1) operating losses of S$5mn at SBST’s bus business; 2) c.3.4% decline in average passenger rail fare; 3) operating losses at China’s bus business. Looking ahead to FY12E, we believe that rail business would likely register a decline in margins as the company increase staff headcount in preparation for the launch of Downtown Line (DTL) at the end of FY13E.

Investment Actions?

We revised our forecasts down by 7.9-11.4% for the next 2 years and lowered our target price to S$1.66 based on 15X FY12E EPS. CDG remains undervalued at the current market price. Maintain Buy.

Ridership grew, Surprise decline in average rail fare

In 4QFY11, SBST’s rail & bus ridership grew by 10% and 4% respectively, reflecting continued success in government’s policy to encourage the use of public transport. During the quarter, public transport fares were increased by an average of 1% in October 2011 to partially offset increase in operating expense for transport operators. Despite this increase in average fare, we estimate that average rail fare for SBST actually declined by 3.4%y-y in 4QFY11. This could be due to lower average distance travelled on the NEL by commuters, following the opening of CCL stage 4 & 5 in the quarter. Average bus fares increased in the quarter.

>>> ComfortDelGro 200MA + Volume Chart

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment