Price Target : S$ 2.90

At a Glance

• FY11 earnings exceeded street expectations due to one-off gain of ~S$10m. Final DPS of 5 Scts was inline

• Maintains 20 Scts DPS guidance for FY12F. Management sees low likelihood of special dividends due to weaker economy

• Weak mobile operating trend is a concern. HOLD for assured 7% yield, the highest in the sector.

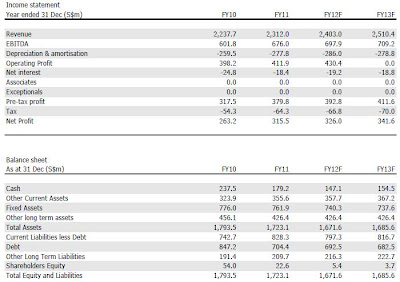

Unexpected one-off gains supported the earnings. FY11F earnings of S$315m (+20% y-o-y) benefited from one-off gains from write back of provisions made for projects completed in the year. Management revealed that excluding the one-off gains, service EBITDA margins should be 30.7% instead of 31.1%. This translated to one-off gains of about S$10m.

Weak mobile operating trends. StarHub added only

30K postpaid subscribers in 2011 versus M1’s 45K and SingTel’s est. 170K. In the prepaid segment, StarHub added only 16K subscribers versus M1’s 59K and SingTel’s est. 112K. StarHub’s overall mobile market share declined to 28.3% (29.4% in FY10), mostly lost to SingTel, with an estimated share of 45.5% (44.2%).

Commendable non-mobile trends despite challenges. StarHub added 7K pay TV subscribers (vs est. 90K by SingTel) to take its base to 545K (est. 355K by SingTel) in 2011 despite a lack of key sports content. In the broadband, StarHub added 18K (est. 22K by SingTel) to take its base to 440K (est. 545K by SingTel).

HOLD for assured 7% yield. FY12F guidance of “low-single digit revenue growth”, “30% service EBITDA margin” and “11% capex to revenue ratio” are healthy. We see downside risk to margin guidance as competitors intend to cross-sell multiple services to their subscriber base. The stock is not cheap at 16x PE, at over +1SD of its historical average of 14x PE.

BUY with higher S$3.10 fair value

• 4Q11 results above expectations

• Guides for S$0.20 dividend in 2012

• Raising FV to S$3.10

Target price: S$3.27

Strong close to 2011.

The feared negative impact on margins from strong iPhone 4S sales did not materialise. Even excluding capexrelated cost provisions, service EBITDA margin was in line with guidance of 30%. StarHub continued to guide for revenue growth and stable margins in 2012, and reiterated its commitment to a stable dividend. Buy with target price of $3.27 based on a 6.5% yield target.

Above expectations. StarHub brought FY11 to a strong close on outstanding performances in almost all segments, especially postpaid mobile. Although full-year net profit of $315.5m included write-backs of capex-related cost provisions, we estimate a net profit of $302m if those write-backs were excluded, in line with consensus. Also, the negative impact feared from iPhone-related subsidies did not materialise as service EBITDA margin was resilient at 30.7% (post-adjustments).

Mobile postpaid outperformed. Postpaid mobile did particularly well as StarHub gained at the high-end. Average revenue per user (ARPU) rose 4% YoY in 4Q11 on the back of an increasing mix of high-end SmartSurf plans. Residential broadband revenue held steady, with netadd of 2,000 customers despite lower ARPU as StarHub drove its hubbing proposition forward. Finally, Pay TV benefited from a commitment fee increase last August.

Margins held up despite strong iPhone 4S sales. Sales of equipment spiked 69% YoY to over 20% of sales on higher iPhone 4S sign-ups. As with M1, StarHub also reported heavy recontracts of the iPhone 4S, launched in end-October, from out-of-contract 3GS users. We expect this to start to normalise in 1Q12 and retreat further in 2Q12. However, margins held up well on lower operating costs. Even after the provision adjustment, EBITDA margin was in line with guidance.

Positive guidance. StarHub’s 2012 guidance of low single-digit growth in revenue and service EBITDA margin of 30% is virtually unchanged from 2011, highlighting management’s confidence despite the slowing economic conditions. In addition to the normal quarterly dividend of $0.05/share declared for 4Q11, management reiterated its commitment to continue its dividend stance, for another $0.20/share in 2012.

Target Price - S$3.31

One-off adjustments

Our FY11 core net profit has been adjusted for:

1) a one-off S$13m reversal of an accrual for the maintenance of network systems; and

2) S$1.9m added back to revenue from a one-off dispute settlement. These adjustments are made after tax. All in all, we adjust our FY12-13 estimates to reflect actual FY11 numbers. Our forecast is broadly in line with guidance.

Little impact from iPhone 4S subsidies

Unlike previous quarters, 4Q11 EBITDA margins rose 1.1% pts despite the launch of iPhone 4S during the quarter. This was because of higher postpaid revenue which offset subsidies for the device.

No surprises in FY12 guidance

StarHub is guiding for FY12 EBITDA margins of around 30%, on the back of a low-single-digit rise in revenue (Figure 3). Capex/revenue should not exceed 11%, which would be lower than the 12% in FY11, despite the spillover of S$25m of spending from FY11. FY11 capex included lumpy capex, including for Nucleus Connect and StarHub’s share of international undersea cable.

Our forecast is in line with StarHub’s, except that we expect it to pay out 25cts in special DPS/capital reduction, in addition to its regular 20ct DPS at the end of FY12.

No comments:

Post a Comment