News and information of Singapore stock market. Chart with Support and Resistance. A blog to force myself to learn.

Apr 26, 2012

CMA earnings growth driven by improved operational

TP of S$2.02

Highlights

Results within expectations, makes up 19% of full-year forecast. CMA reported PATMI of S$66.8m, up 36% y-o-y on a 41% higher revenue of S$70.9m. Stripping out S$30m of fair value gains from the acquisition of the remaining stakes in three Japan assets, a bottom-line of S$36m makes up c19% of our full-year estimate. Contributing to earnings were also better operating performances in Singapore, China and Queensbay Mall in Malaysia; a small maiden S$2m contribution from the purchase of the remaining 50% stake in the Minhang and Hongkou malls ( acquired last month); and increased income from a higher stake in three Japan assets. Portfolio-wise, NPI yield continued to improve across its major markets (except for Japan and India) with Singapore rising from

5.5% as at December 2011 to 5.7% in Q1, China 5.6% to 6.4% and Malaysia 6.5% to 7.1%, as shopper traffic and tenant sales continued growing by 1-10% and 2-13% respectively.

Our View

Earnings on a growth path. Forward earnings will continue to be lifted by a full nine-months' income from the additional 50% stake in Minhang and Hongkou Plaza, and contributions from Star Vista in Singapore (scheduled to be completed in August 2012), as well as continued improvement in operations at existing malls. In addition, the group plans to open seven malls in China this year. Contributions from these properties should be felt from FY13 onwards. CMA has also announced that it has acquired a development site in Tiangongyuan, in the south of Beijing, for the development a 122,000sm GFA retail mall. This is its first investment into south Beijing and deepens the group's presence in Beijing to nine malls. The mall is expected to be completed in 2015 at a cost of Rmb2.34b (or Rmb19200psm). This will extend the group's development pipeline of directly-owned projects in China. Its balance sheet remains healthy with a gearing of 15% as at 1Q12 (c 23% post-acquisition of Minhang and Hongkou) and with a projected capex of S$600-800m annually over the next two years. Gearing is expected to continue rising but at a modest pace.

Recommendation

Maintain BUY. We are raising our FY12 PATMI from S$191m to S$205m to take into account fair value gains. We are leaving our FY13 numbers unchanged. Our RNAV of S$2.52 and TP of S$2.02 are maintained. We continue to like CMA for its leadership position in the Asian retail real estate market. With the gradual completion and commencement of operations of its properties as well as the ramping up of its ongoing operations, we believe earnings and NAV growth should be sustainable.

Segmental performance by country

Revenue from Singapore was 16.4% y-y higher (see Fig 6) mainly due to higher fee income. The absence of development profit from Orchard Residences, lower contribution from CMT and higher staff costs and expenses however lead to lower Ebit of $32.5mn (-31.8% y-y).

China reported overall improvement, due to higher fee income and rental from operating malls. At the share of results from jointly-controlled entities level, Minhang and Hongkou Plaza contributed ~S$2mn, and CRCT also reported improved performance. Ebit was 50.7% higher at $12.5mn.

CMA had in February acquired the remaining 71.7% interest in 3 of the 7 malls in Japan with ~$217.4mn (on 100% basis). That improved the revenue from Japan to $3.1mn and Ebit to $32.6mn in 1Q12 due to reval gain. The management expects the acquisition could improve PATMI from Japan by ~$8mn p.a..

Acquires site in South Beijing for mall development

CMA also announced that it is acquiring a 39,500sqm site located in Daxing district, Beijing for development of a shopping mall. The total development cost is about RMB2,343.0mn (S$469.2 mn), or about RMB19,190 (S$3,843) psm based on the estimated GFA of 122,000 sqm. The seller, Poly Real Estate Group, which is one of the 5 largest property developers in China, will continue to develop residential apartments next to the site. The subject site is located above Tiangongyuan Station on the Daxing subway line, with plan for a new bus interchange to be built in the next 3 years. Plan is also underway for the second international airport of Beijing to be built in Daxing, which shall raise the attractiveness of the district for business and living.

Acquisition momentum continued

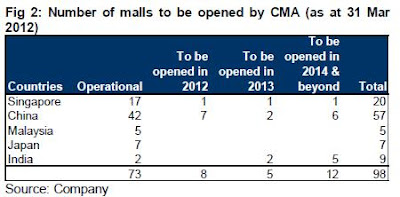

Having spent $3.4bn on acquisitions in 2011, CMA did not let the momentum slow down and went on for another 2 acquisitions YTD. Currently it has 98 malls in portfolio, with 73 operational. We are excited about the malls opening pipeline, which will see another 8 malls opening this year, following JCube in Singapore that had started operation in early April.

Financial position

CMA had cash-on-hand of ~$930mn as of 1Q12 after spent on acquisition of 3 malls in Japan and paid for 50% stakes in Minhang and Hongkou Plaza, and issued S$400mn retail bond in Jan 2012. Net D/E increased from 0.04x in 4Q11 to 0.15x, and we expect it to gear up to 0.32x by end-FY12 after factoring in the new acquisition of Tiangongyuan site and capex for other development projects on hand. The management guided that capex of about $600 – 800mn p.a. is required on development projects for the next 2 years, and will continue to raise capital thru bond issue when necessary.

Earnings forecast

We revised our estimates to factor in the additional contributions from the 3 Japan malls and increase the gearing estimates. Our FY12 revenue/adj PATMI are increased by c10%/c4% respectively to $229.9mn and $196.4mn. The reported revenue and adj PATMI were 31% and 18% of our revised estimates. We expect the bottom line to catch up in the later part of the year when the contributions from those new acquisitions come in fully.

Maintain Buy with fair value lower to $1.75

We factor in the new acquisitions into our RNAV and increase our net debt estimates due to higher capex, fair value is thus lowered from $1.77 to $1.75. We maintain our Buy recommendation. Although retail consumption in China eased slightly in 1Q12 to YTD 14.8%, the pace of growth is still strong in our view.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment