News and information of Singapore stock market. Chart with Support and Resistance. A blog to force myself to learn.

May 7, 2012

MMH sequential improvement despite seasonally weak quarter

Fair value S$0.325

3QFY12 results in line with expectations

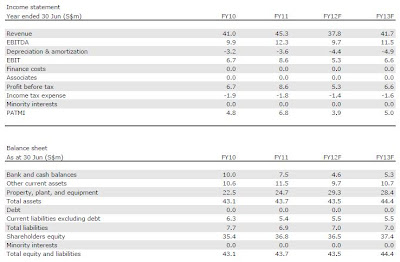

Micro-Mechanics Holdings (MMH) reported its 3QFY12 results which were in line with our expectations. Revenue declined 15.8% YoY to S$9.4m, or 2.9% higher than our forecast. Net profit slumped 47.8% YoY to S$0.9m and was just 0.4% above our projections due largely to a higher-than-estimated effective tax rate. Sequentially, revenue and net profit rose 7.2% and 16.7%, respectively, despite 3Q being a seasonally weak quarter. We believe this provides a positive signal that MMH could experience a gradual improvement moving forward, in line with the recovery in the semiconductor industry. For 9MFY12, topline fell 16.8% to S$28.4m, while bottomline dipped 47.6% to S$2.9m.

Still awaiting a turnaround in its CMA division

Despite the challenging conditions, MMH managed to maintain its gross margin at

46.0% in 3QFY12, versus 45.4% in 3QFY11. This was attributed to a control in its production headcount and better product mix. While its Custom Machining & Assembly (CMA) division saw a 11.9ppt QoQ jump in its gross margin to 12.0%, it remained mired in a loss. Nevertheless, its new 24/7 automated manufacturing system could prove to be a ‘game changer’ for the segment, given its ability to manufacture complex parts in an efficient manner. MMH is currently still carrying out the commissioning of the system, but we understand that initial feedback from its customers has been positive. Contribution could begin in 1QFY13.

Outlook a tad more optimistic

MMH’s management sounded more upbeat during the analyst briefing, highlighting an improvement in sentiment for some of its customers; although the group remains cautious on the uncertain global economic environment. We reckon that MMH would strive to further improve its product cycle time to increase its competitiveness and responsiveness to its customers. We maintain our projections as MMH’s results were within our expectations. But we raise our fair value estimate from S$0.29 to S$0.325 as we roll forward our valuations to 9x FY13F EPS.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment