News and information of Singapore stock market. Chart with Support and Resistance. A blog to force myself to learn.

May 22, 2012

Olam cotton and commodity financial services hit earnings

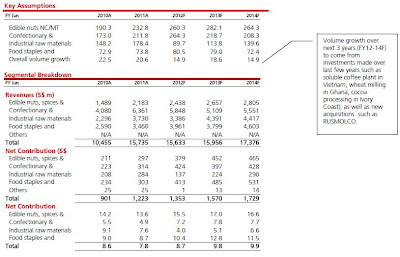

3QFY12 profit below. Excluding biological gains, Olam reported 3QFY11 core profit of S$80m (-26% y-o-y) representing 24% of our forecast, while 9M12 core profit of S$208.7m made up 61%. This was below expectations as 9M usually constitutes 65-80% of profits.

Cotton disappointed again as Olam was unable to procure cotton from Australian farmers who withheld supply in anticipation of higher prices. In addition to weak demand for timber, Industrial Raw Materials volumes and net contribution (NC) declined by 7% and 49% y-o-y respectively. Commodity Financial Services (CFS) also struggled, leading to a 91% y-o-y fall in NC. These two segments offset the 18-38% rise in NC from Edible Nuts, Confectionery and Food Staple segments.

FY12-14F profit cut by 13-31%, as we trim margin outlook on a projected softer commodity price environment. We now assume group FY12-14 NC/MT to range between

S$131-138 versus S$144-151 previously. With farmers expected to sell their cotton stock over course of 1Q-2QFY13, we also bump up FY13 Industrial Raw Material output by 5% while NC/MT margins should recover from S$90 in FY12F to S$114 in FY13F. With earnings estimates lowered and the expectations for slower cash conversion cycle, our DCF-based TP is accordingly cut to S$2.00 from S$2.75.

Maintain Hold, given no price upside to our revised TP of S$2.00, expectations of soft 4QFY12 results due to lingering weakness in the cotton segment and negative sentiment surrounding supply manager stocks after the recent set of poor results.

Second consecutive quarter of weak results

Olam delivered another weak quarter, the second consecutive quarter of y-o-y decline in profits. Excluding biological gains, 3QFY12 core profit stood at S$80m (-26% y-o-y) representing 24% of our forecasts, while 9M12 core profit of S$208.7m accounted for 61%. This was below expectations as 9M usually contributes 65-80% of profits.

Main drag continues to emanate from the cotton segment and underperformance from CFS (commodity financial services).

Cotton hits earnings again

Olam’s Industrial Raw Materials segment recorded 7% y-o-y decline in volumes to 381k MT and 24% fall in net contribution (NC) to S$33.2m. Weakness came from the cotton business as Olam was unable to purchase its usual cotton volumes. Farmers in Australia withheld stock during the quarter in anticipation of prices recovering. Given the current weak cotton prices, Olam also expects farmers to continue to delay selling their cotton into 4QFY12. However the company should recover these “lost” volumes over 1QFY13 and 2QFY13 ahead of next year’s harvesting season. By end of this year, there is unlikely to be any storage facilities left, forcing farmers to sell their cotton to Olam.

Commodity Financial Services underperforms

Commodity Financial Services (CFS) division continues to underperform due to limited arbitrage opportunities and derisking of the business given the uncertain macro outlook. Net contribution dived 85% q-o-q and 91% y-o-y to S$0.4m. While Olam remains hopeful of a recovery after investment in the business over the last 3 years, we expect minimal contribution from the business going forward until there is consistent earnings delivery.

Other segments supporting the business

Despite weakness in Industry Raw Materials and CFS, Olam’s other divisions (Edible Nuts, Confectionery and Food Staples) continue to perform well.

Volumes for Nuts, Confectionery & Beverage and Food Staples rose 15%, 5% and 40% y-o-y respectively. The strong volume growth in Food Staples was driven by the Rice and Grains business in Africa as the group successfully commissioned its wheat mill in Ghana. However lower ASPs y-o-y (with exception of Food Staples) translated into revenues declining by 15-26%. Overall, 3QFY12 group sales fell 11% y-o-y to S$4,231m.

Given increased contribution from higher margin upstream assets and synergy gains from integration of acquired businesses, Olam saw the following improvement in segmental margins.

1. Edible Nuts’ 3QFY12 NC/MT improved to US$284 from US$236 in prior year, translating to NC of S$111.7m (+38% y-o-y)

2. Confectionery’s 3QFY12 NC/MT rose to US$203 from US$171 in prior year, resulting in NC of S$109.1m (+25% y-o-y)

Food Staples 3QFY12 NC/MT however fell to US$58 from US$69 in 3QFY11 due to change in business mix (ie higher contribution from lower margin grain business) and continued tough trading conditions in dairy. Food Staples NC however rose 18% y-o-y to S$80.2m mainly due to higher volumes (+40% y-o-y)

Cash conversion cycle deteriorated

Slower buying of cotton supplies and weaker cotton demand lead to receivable turnover increasing to 35 days versus 31 days at end Dec11 and 122 inventory days compared to 118 in 2QFY12. This resulted in cash conversion cycle deteriorating to 148 days from 133 days at end Dec11.

The weaker cash generation caused a slight increase in leverage with adjusted net debt/equity (excluding readily marketable inventories and secured debtors) increasing to 45% from 43% at end Dec11. However, financial position remains strong with available liquidity of S$10.2bn

FY12F-14F earnings cut by 13-31%

Reflecting the continued economic uncertainty affecting Industrial Raw Materials’ outlook, weak year to date performance and lower assumed commodity prices, we lower our FY12-14F earnings by 13-31%. Earnings in S$ has also been negatively impacted by stronger assumed US$/S$ FX rate. We now assume group FY12-14 NC/MT to range between S$131-138 versus S$144-151 previously.

While FY12 profits are expected to be flat y-o-y, we expect earnings to recover in FY13 (+13% y-o-y). Key factor to drive the recovery is the cotton segment. Farmers are expected to sell their cotton stock over 1Q-2QFY13 which translates to our FY13F Industrial Raw Material volumes being raised by 5%. On the margin front, to be conservative given the uncertain macro outlook, NC/MT is forecasts to recover to S$114 from S$90.

TP lowered to S$2.00

With lower projected earnings and slower cash conversion cycle to reflect higher inventory days due to slower sales cycle for cotton our DCF-based TP is cut to S$2.00 from S$2.75.

Maintain Hold

Given the lack of upside to our revised TP of S$2.00 we maintain our Hold call. While we expect earnings to recover next year, we think it is too early to accumulate Olam as we see limited potential for any near term re-rating catalysts. 4QFY12 results should still be soft due to continuing issues in cotton while sentiment remains weak in the midst of correction in agricultural commodity prices (the S&P GSCI Agriculture Index is down 9% from end Mar11) and recent disappointing results from supply chain managers.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment