News and information of Singapore stock market. Chart with Support and Resistance. A blog to force myself to learn.

May 20, 2012

SATS has a 5-year ordinary dividend payout ratio of 70%

Target price $3.04

Good results, bumper dividend. SATS reported FY12 results that were in line with expectations at SGD 171 mil. As a more meaningful comparison, its 4Q12 Net Profit from continuing operations of SGD 48 mil was flat YoY, while on a full-year basis, profit declined marginally by 4% to SGD 178 mil, which was a creditable performance against the year’s challenging operating environment. Bumper dividends were also declared (final plus special) of SG 21 cts/sh, as a disbursement from their sale of the Daniels group. Together with the interim dividend of SG 5 cts/sh, total dividend yield of 10% is rather attractive.

The worst seemingly over in Japan. TFK has seemingly turned a corner after the Japanese earthquake disaster in Mar 2011 which severely affected its operations. TFK has shown 4 consecutive quarters of improvement since then, culminating in a turnaround from an SGD 1.6 mil loss in FY11 to a

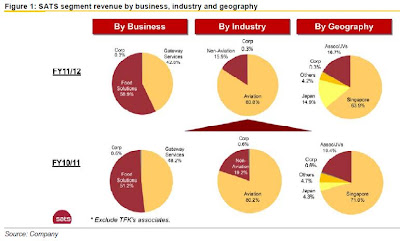

SGD 0.3 mil profit in FY12. Also, from a geographical standpoint, Figure 1 shows the increased contribution from Japan to Group revenue. We expect further recovery in TFK’s performance as a key growth driver for the Group going forward.

Bumper dividends to be the norm? SATS has historically been sitting on a healthy net cash position. Figure 2 shows that SATS has a 5-year ordinary dividend payout ratio of 70%. We think that based on its strong cashflow and large net cash position, there is justification for a payout ratio closer to 100%, which would still leave sufficient cash for potential acquisitions in the non-aviation-related space.

On solid ground, Maintain BUY. SATS continues to remain a company with solid fundamentals, with growth drivers largely intact. We believe that its resilient earnings amidst a volatile economic climate and possibly higher dividend payouts justify a valuation upgrade to 17x FY13 PER, based on 1 standard deviation above its mean. Maintain BUY, with target price increased to $3.04.

Singapore: Positives for Passengers; Cargo Concerns

Changi Airport Group trends. Based on the latest operating figures (Figures 3 & 4) from the Changi Airport Group, there was a 13% YoY growth in 1Q2012 passenger movement. In addition, for calendar year 2012, the Singapore Tourism Board (STB) has forecasted a 10% growth in visitor arrivals. These figures point towards healthy passenger traffic and present growth opportunities for the Group’s gateway and food businesses in Singapore. However cargo operations still remain in the doldrums, showing flat growth for 1Q12 and remain a key risk and drag on performance. Management expects cargo volumes to only pick up in the latter half of this year.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment