News and information of Singapore stock market. Chart with Support and Resistance. A blog to force myself to learn.

Jul 24, 2012

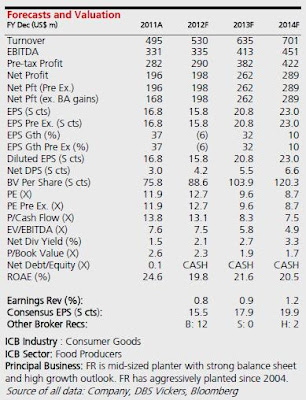

FY12F-14F earnings tweaked c.1% higher

1H12 output ahead of expectations. First Resources’ (FR) 2Q12 CPO output had risen 5% q-o-q to 115.4k MT. This had brought 1H12 CPO volume up to 225.5k MT (+21% y-o-y), representing 47% of our initial expectations – slightly ahead on an annualised basis. This was due to better-than-expected 2Q12 smallholder FFB output, which had jumped 21% q-o-q. However, 2Q12 CPO price (net of export taxes) had averaged US$828/MT (-7% q-o-q) – cancelling off the group’s robust sequential volume growth. Assuming the group’s palm oil inventory had not increased, FR should book 2Q12 earnings of US$41-46m (or 5-16% lower q-o-q). Unlike its peers, FR did not experience any adverse effects from 1H10’s El Nino, which suggests that its 2H12 output should remain normal. The group should also continue to benefit from strong spot refining margins in 2Q12, estimated to average US$89/MT vs US$4/MT in Malaysia.

FY12F-14F earnings tweaked by c.1% higher. We have adjusted FR’s FY12F-14F palm oil output by 1.3-1.8% to reflect its 1H12 performance. FR’s CPO output is now projected to grow by 8.3% CAGR between 2011 and 2014 from 7.9% previously. This has resulted in a slight upward adjustment of

c.1% to FY12F-14F earnings – but no change to our valuation of S$2.15. Please note that we have not yet imputed the impact from the reported issuance of RM600m Sukuk (maturing 31 July, 2017, bearing an implied coupon of 4.45%), pending an official announcement.

Rating cut to HOLD. While FR’s long term prospects remains robust with three-year earnings CAGR of 19.7%; we believe this has been priced in. With only an 8% upside to our TP of S$2.15 and the stock outperforming STI and CPO price by 23% and 45% YTD, we suggest investors lock in gains now.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment