News and information of Singapore stock market. Chart with Support and Resistance. A blog to force myself to learn.

Jul 2, 2012

Tat Hong No. 1 in Asia-Pacific in terms of crawler fleet size

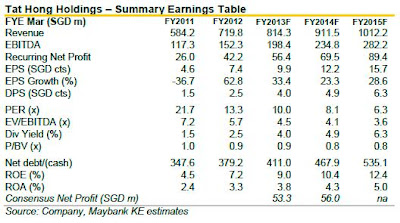

Initiate with BUY and target price of SGD1.41. We initiate coverage on Tat Hong Holdings with a BUY recommendation and target price of SGD1.41, pegged at 14x FY3/13F PER. We like Tat Hong for its predominant position in the local crane rental industry as well as wide reach overseas. While improving operating statistics clearly signal that the group is recovering from its trough, its China business also appears poised for a turnaround. We thus expect net profit to grow at 28.4% CAGR over the next three years.

More stable business model. As Tat Hong’s rental business, which enjoys more stable demand, begins to make up a bigger chunk of its total gross profit, earnings volatility should ease in tandem. A less volatile and cyclical business model will justify a higher valuation for the share price, in our view.

Tapping the infrastructure boom. A decade of economic growth in Asia has put a huge strain on the infrastructure of many countries in the region. However, government bailouts around the world in response to the global financial crisis have led to a massive increase in public works spending, boosting demand for infrastructure construction. Tat Hong stands to benefit from this infrastructure boom in the medium term.

Recovery from trough. Over the past four quarters, Tat Hong’s key operating statistics,

ie, fleet size, utilisation and rental rates, have shown significant improvement. The trend looks set to continue for the next 2-3 years, buoyed by high demand in the region. We expect Tat Hong’s net profit to double from SGD42.2m currently by FY3/15F.

Turnaround in China business. Tat Hong set up operations in China in 2009 but it was plagued by local shareholder issues and did not contribute to the group’s previous earnings peak in FY3/08. However, as the shareholder issues get resolved and China steps up its infrastructure development efforts, we expect Tat Hong’s China business to turn around and help push earnings to a new peak.

Investment thesis

More stable business model. Tat Hong used to grapple with lumpy earnings due to the cyclical nature of its equipment sales business. But we expect this situation to ease in the future as its crane and other equipment rental business, which enjoys more stable demand, makes up a bigger chunk of the group’s total gross profit.

Tapping Asia’s infrastructure spending boom. A decade of strong economic growth in Asia has put a huge strain on the infrastructure of many countries in the region. Governments have been galvanised into action upon realising that a lack of coordinated infrastructure investment would stifle growth and hurt the economy. Add to this the wave of government bailouts around the world in response to the global financial crisis and there have been a massive increase in public works spending, boosting demand for infrastructure construction. Recent natural disasters in Australia and other parts of Asia mean additional demand from recovery construction. In our view, Tat Hong stands to benefit from this infrastructure boom in the medium term.

Recovery from trough with brighter prospects ahead. Over the past four quarters, Tat Hong’s key operating statistics, ie, fleet size, utilisation and rental rates, have shown significant improvement. The trend looks set to continue for the next 2-3 years, buoyed by high demand in the region. We therefore believe that it would not be long before Tat Hong’s earnings hit a new high again.

Turnaround in China business. We expect Tat Hong’s China business to turn around within the next two years now that its local shareholder issues have been largely resolved. Demand would continue to be fuelled by Beijing’s enormous infrastructure spending, while intensive new capital investment may not be needed as the relatively low utilisation rate in China currently would provide sufficient capacity. The much-talked about property bubble is also no cause for concern because Tat Hong only has projects in the energy and transport sectors in China; the real estate sector has never been its cup of tea. Against this backdrop, we expect gross profit growth of 38% in FY3/13F and 31% in FY3/14F.

Initiate coverage with BUY and target price of SGD1.41. We initiate coverage on Tat Hong with a BUY recommendation and target price of SGD1.41. Our valuation methodology is premised on the PE multiple, which we set at FY3/13F 14x. We have also conducted a replacement cost analysis and found that despite a 12.5% YTD increase in Tat Hong’s share price, there is still at least 33% uncovered value. Put simply, at the current price, investors are buying Tat Hong’s physical assets at a 33% discount while enjoying for free all the other intangibles such as its client relationship, reputation and distribution network.

Company background

No. 1 in Asia-Pacific in terms of crawler fleet size

Tat Hong was established in Singapore in the 1970s as a supplier of cranes and other heavy equipment. It is currently one of the world’s largest crane companies, ranked No. 1 in Asia Pacific in terms of crawler crane fleet size and No. 8 in the world in terms of aggregate tonne-metres. The group has offices in 26 cities across Australia, China and ASEAN, as well as activities in other parts of the world including Europe, the Middle East and South Africa. Tat Hong leases or sells cranes and other general equipment to a variety of industries including infrastructure, oil and gas, mining, construction and engineering. It owns a combined rental fleet of more than 1,000 mobile, crawler and tower cranes throughout the region, and also enjoys exclusive distributorship agreements for cranes and other heavy equipment.

Business segments

Rental business. Comprising three divisions, namely, crawler crane, general equipment and tower crane, the rental business is Tat Hong’s core earnings growth driver. Customers include local and international contractors in the oil and gas, infrastructure, petrochemical, processing, and building and construction industries.

- Crawler crane rental: This is Tat Hong’s best-performing business division with the highest gross margin. The group is a big player in the crawler crane rental business in the region and owns a fleet of 627 crawler cranes that are leased to customers in Australia and ASEAN. This segment contributed 31% of group revenue and 50% of group gross profit in FY3/12.

- General equipment rental: This business was set up in 1996 through the acquisition of Australia-based Tutt Bryant Group. It provides heavy lifting and haulage and offshore and marine services to clients across Australia. This segment contributed 14% of group revenue and 16% of group gross profit in FY3/12.

- Tower crane rental: This is Tat Hong’s newest rental business and is located in China. Fleet size has expanded to over 500 tower cranes since the group entered this market in 2005. It now has five tower crane rental subsidiaries and is the biggest tower crane rental company in China. This business segment contributed 8% of group revenue and 9% of group gross profit in FY3/12.

Distribution business. Tat Hong is also engaged in equipment sales and other related businesses. This segment accounted for 47% of group revenue and 25% of group gross profit in FY3/12. In 1993 the group clinched the exclusive distributorship for Sumitomo cranes in Singapore, Malaysia, Brunei, Thailand and Hong Kong. Since then, it has won similar agreements for more equipment types under the Hitachi-Sumitomo and Hitachi brand names, as well as distribution to other countries such as Australia, Indonesia and Vietnam. Today, Tat Hong is the exclusive distributor of a wide range of cranes and heavy equipment for well-established brand names such as Hitachi-Sumitomo, Hitachi, Sumitomo Yanmar, Bomag, Kato, Mustang, Kawasaki, Mitsubishi and Linkbelt. Thanks to its ties with these customers, it has also expanded its services to cover the sale of spare parts, equipment maintenance as well as repair and training programmes for crane and heavy equipment operators.

More stable business model

Dogged by earnings volatility. Tat Hong has been grappling with lumpy earnings in the past few years due to unstable global demand for cranes and other heavy equipment. A closer examination of its gross profit trend showed that its distribution segment was the underlying cause of earnings volatility, in contrast to the rental segment, in particular the crane rental business, which had remained relatively stable. Between FY3/08 and FY3/11, annual gross profit for the distribution business swung from SGD87.0m to SGD44.8m while gross profit for the crane rental segment only moved within a narrow range of SGD112.6m to SGD102.3m.

Why Rental business is more stable? Tat Hong’s “distribution” business is primarily located in Australia with limited industries’ exposure. This explains why it is highly sensitive to the vagaries of economic cycles. However Tat Hong’s crane rental business is more diversified, both geographically and industrial wise. It operates in Australia, Singapore, Malaysia, Indonesia and Hong Kong, and caters to different industries including building, construction, infrastructure, mining and oil and gas. This diversity means that the group can always find demand somewhere to compensate for the slowdown in certain markets or industries. Even if all markets and all industries were to slow down simultaneously, we believe that the distribution business will get hit before the rental business because there would still be some activities that would require leasing its existing cranes.

Growth to offset earnings volatility. Tat Hong values both its distribution and rental businesses and will continue to grow them. Over time, we expect the crane rental business to make up a bigger chunk of the group’s gross profit as the gross profit margin for this business (over 55%) is much higher than that for the distribution business (around 20%). In short, earnings volatility will be gradually mitigated at the gross profit level. We expect the crane rental business to contribute 55.2% of group gross profit in FY3/15F vs 49.7% in FY3/11.

Three revenue growth drivers. We have identified three revenue growth drivers for Tat Hong for the next three years. They are:

1. Current infrastructure boom in the region,

2. Utilisation and rental rates approaching optimum, and

3. Short-term rental strategy for majority of contracts.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment