News and information of Singapore stock market. Chart with Support and Resistance. A blog to force myself to learn.

Jul 11, 2012

StarHub: It’s Been A Stellar Ride

- StarHub has given us stellar returns of 67% since we first called BUY in 2010. However, it is time to take profits off the table as the stock is now trading at the tightest dividend yield/bond yield spread in its history, and dividend yield is now barely covering inflation. Downgrade to SELL.

- The stock has almost reached our DDM-derived target price which has already assumed an anticipated 20% increase in dividends. However, as 4G spectrum auctions loom in 2013, we fear there may be no room to raise dividends. If so, our original investment thesis has faded.

- The IPO of undersea cable operator Global Telecommunications Infrastructure Trust may also give investors a good excuse to take profit on StarHub. GTI Trust, a unit of India’s Reliance Communications, is reported by Reuters to be offering a distribution yield of 9.5%-11.5% on its indicative price of USD1.09-1.32 per unit.

Time to say goodbye. Our long-standing buy call on StarHub has been rewarding. However, it is time to say goodbye and we advise clients to take profit. The stock has raced to an all-time high amidst the current risk-off environment and its dividend yield has compressed to the lowest level since listing. Going by our DDM model, the share price has already discounted a 20% rise in dividends, but our original expectations of higher dividends may be dashed by an upcoming 4G spectrum auction in 2013. Management has also indicated there will be no capital management or reduction initiatives. Assuming dividends stay flat at SGD0.20 a share, our DDM-derived target price is SGD3.04 or 15% below the current level. SELL into the current strength.

Stock is overvalued if dividend stays put. StarHub has almost reached our DDM-derived TP of SGD3.64, which had assumed a 20% rise in annual dividends to SGD0.24 a share. However, the 4G spectrum auction in 2013 may lead to a rise in cash commitment next year, which could reduce the company’s willingness to increase dividend payout. If dividends stay put at the current SGD0.20 a share, the stock is now overvalued, with a DDM-derived TP of SGD3.04.

Spectrum cost to push up 2013 cash needs. Using past auctions to provide a pricing benchmark, StarHub may need to pay SGD110-131m for refarmed 4G spectrum. An auction is likely to be held in 1H 2013. This could bump up 2013 cash requirements by 43-51% and push 2013 net debt/EBITDA from 0.63x to 0.78-0.81x. While this should not endanger its current SGD0.20 DPS, it may undermine our original thesis that StarHub can afford to increase its dividends.

Absolute valuations also difficult to justify. At the current level, StarHub is yielding just 5.6% on its ordinary dividend, the lowest since it was listed in 2004 and started paying dividends in 2005. The spread between dividend yield and the 10-year Singapore government bond yield has also narrowed to its tightest level yet, a mere 400bp, since the bond itself was issued in 2007. Dividend yield is also barely hedging against domestic inflation of 5% (as at May 2012).

At an all time high

Taking profit on long-standing BUY call. Our long-standing BUY call in StarHub has been rewarding. Since we turned bullish in early 2010, the stock’s returns have totalled 54% before dividends and 69% including dividends. However, it is time to say goodbye and we advise clients to take profit on their long positions. The stock has raced to an all-time high amidst the current risk-off environment and dividend yield has been compressed to its lowest level since 2007, while our original expectations of an increase in ordinary dividends may be capped by an upcoming 4G spectrum auction in 2013. Management has also indicated there will be no capital management or reduction initiatives.

Valuations can no longer be justified. At the current share price, StarHub is yielding just 5.6% on its ordinary dividend of SGD0.20 a share, the lowest since the stock was listed in 2004 and started paying dividends in 2005. The spread between yield and the 10-year Singapore government bond yield has also narrowed to its smallest level, a mere 400bp, since the bond itself was issued in 2007. Given the risk of a possible rise in capex in 2013 if StarHub has to compete for 4G spectrum against SingTel and M1, we believe this small spread can no longer compensate for staying long in the stock. Further, the stock has reached our DDM-derived target price, which already assumes a 20% rise in ordinary dividends from SGD0.20 a year to SGD0.24 a year.

4G spectrum auction in 2013

Consultations ongoing on 4G spectrum refarming. The Infocomm Development Authority (IDA) is currently consulting the telecom industry on refarming the 1800MHz, 2.3GHz and 2.5GHz spectrum bands from their current usage to 4G services. All three telcos are already rolling out 4G services on their existing 2.3GHz and 2.6GHz spectrum but the availability of 1800MHz will allow them to enhance in-building coverage.

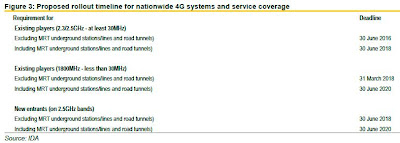

An auction is likely to be held in 2013. We think the auction is likely to be held sooner rather than later in order (possibly in 1H 2013, in line with media reports), to give the telcos enough time to roll out their LTE infrastructure to cover the entire country, which the government has stipulated it wants to include buildings and structures such as road tunnels and underground MRT lines/stations by 2016, 2018 and 2020, depending on the spectrum.

Not enough spectrum to go around

Only 140MHz of 1800MHz spectrum to replace 150MHz. We note that IDA is proposing to make available only 140MHz of the crucial 1800MHz spectrum for refarming but the telcos are currently allocated 150MHz (2x25MHz each) that will expire in 2017. IDA is assuming that, as the telcos all plan to use FDD technology (Frequency Division Duplex) instead of TDD (Time Division Duplex), there will be more efficient use of spectrum for 4G.

With FDD, the uplink and downlink data is sent on different frequencies (hence the bands are always referred to in “pairs”). TDD, which uses a single frequency for both links but relies on complex circuitry to separate the two data streams, tends to waste more bandwidth during the switchover from transmitting to receiving. It also requires a guard band between base stations, which reduces spectral efficiency.

Absolute minimum needed is more. Our discussions with the telcos however suggest that 2x20MHz is an absolute minimum and 2x25MHz in a single, contiguous block will be much more optimum, especially since the regulator is pushing for in-building and underground coverage with very ambitious timelines as well. While there is a possibility the telcos are just trying to convince IDA to release more spectrum and therefore keep costs down, we do not think so. We think there is really a scarcity of spectrum.

Cash commitment likely to rise

Spectrum fees will add to 2013 cash commitment. Spectrum is a scarce national resource, and having more is always better than not having enough. Hence, we think each of the telcos will want to make sure they get their fair share of the pie even if there are no new entrants and their bids are rational. In every scenario we looked at, we think that capex will rise in 2013.

Since there is not enough spectrum available for complete replacement of the telcos’ existing bandwidth, but given the need to avoid a price escalation for everyone, we have assumed that SingTel and StarHub will bid for 2x25MHz (full replacement) while smaller M1 may go for a lower 2x20MHz as it has more 900MHz bandwidth that can be redeployed for 4G. It is unlikely that SingTel will settle for less given its deep pockets.

Using past pricing for 1800/1900MHz spectrum auctions achieved in 2010 and 2011, StarHub may have to pay about SGD110m for the 1800MHz spectrum, which could increase 2013 cash requirements by 43%. Assuming borrowings are used to fund the additional commitment, its 2013 forecasted net debt/EBITDA could rise from 0.63x to 0.78x. This is still a reasonable gearing level.

On a worst case scenario where every telco bids for complete replacement and drives up the price by 20% over the price M1 paid for the last 1800MHz auction, StarHub may have to pay up to SGD131m. This may happen if IDA does not increase spectrum allocation. In this case, StarHub net debt/EBITDA could rise to 0.81x. However, we deem it as a low probability scenario as M1 is unlikely to have the financial muscle.

Dividends to be maintained at best

Should not affect current dividend payout. The hike in capex and net debt/EBITDA are unlikely to affect StarHub’s annual dividend of SGD0.20 a share. To put it more clearly, we do not think it will result in a cut of dividends by StarHub. Despite net debt/EBITDA rising to 0.78x and even 0.81x under our worst case scenario, this is still reasonable given its strong cashflow and balance sheet.

But likely no further upside to current dividends. However, it may influence StarHub’s willingness to pay out additional dividends on top of the current ordinary dividend. If so, this would undermine our key investment thesis, that StarHub needs to pay out more dividends in order to stop a build-up in cash and prevent accusations of a lazy balance sheet.

Valuations have raced ahead of reality

As it stands, our DDM-derived target price of SGD3.64 already assumes a 20% increase in ordinary dividends from SGD0.20 a share to SGD0.24 a share. In other words, the stock has already priced in higher forward dividends, but the latest development over spectrum cost puts that assumption under the cast of some doubt.

In addition, the management has made clear that it is not considering any capital management initiatives including a special dividend or capital reduction. Hence, although we are still a fan of StarHub in the long term, we think that the stock has moved ahead of reality for the time being.

Key assumptions

First, IDA has not yet set a reserve price for the proposed 4G spectrum. However, we think that it would be safe to say that SGD100m is the minimum capex sum to consider, assuming that StarHub guns for the same amount of 3G spectrum that it currently has, which is 2x20MHz (it was awarded 2x15MHz in 2001 and another 2x15MHz in 2010).

Second, we do not expect any new entrants to make bids other than the incumbent telcos, given the small size and maturity of the Singapore market. Other than the auction for wireless broadband spectrum in 2005, we note that only the listed telcos participated in the 2001, 2010 and 2011 spectrum auctions. Even for the 2011 auction, in which M1 won an additional 2x5MHz of 1800MHz spectrum, we believe StarHub and SingTel bidded just to drive up the cost for M1 than any real desire to own the spectrum.

Third, we think the 1800MHz lots will be most keenly bidded for, as the lower the frequency, the better the spectrum can penetrate objects (such as walls) and the further it can travel. Hence, our scenario analysis has focused on the 1800MHz spectrum.

Fourth, we think there will be less interest in the 2.3GHz and 2.5GHz spectrum. The higher the frequencies, the shorter the distance the signal travels before it fades, and will be impeded to a greater extent by obstacles such as buildings or even the humidity in the air. In addition, we note that each of the telcos already has 2x12MHz of 2.6GHz spectrum, which they are already using to roll out 4G coverage. Having said that, there may be some interest in the 2.5GHz bands as IDA’s coverage requirement includes not just the main island but also the offshore islands and territorial waters up to 15km from the coastline of Singapore. However, the cost is likely to be negligible at an estimated SGD3m per lot. However, there may be no interest for the 2.3GHz band as it is for TDD technology.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment