Target S$2.56

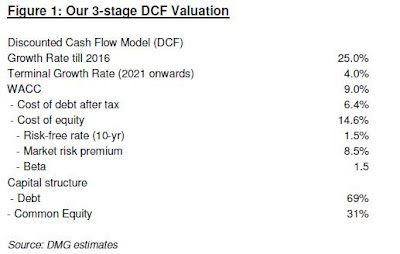

Olam reported 4QFY12 net profit of S$110m, down 14% YoY. If we strip out the effects from biological gains exceeding our forecast, adjusted net profit would be S$71m, below our S$91m forecast. This weakness is due to higher expenses. There was YoY earnings weakness from the industrial raw materials space, but food continues to power ahead. We lowered our FY13 net profit forecast by 6% to factor in continued cotton and wood weakness and higher costs. Remain positive on food, which accounted for 87% share of net contribution. Olam trades at a FY13F P/E of 10.8x, which is inexpensive versus FY13F net profit growth of 21%. Maintain BUY with an unchanged target price of S$2.56, derived from a 3-stage DCF valuation model. Our TP translates to a FY13 P/E of 13.9x, which is lower than the historical average of 17x.

Food still thriving. The three food segments collectively recorded FY12 NC growth of 32%. In contrast, the industrial raw materials suffered a 41% plunge in NC, with cotton origination affected by extreme market volatility, demand illiquidity and declining volumes. As the food segments account for 87% share of NC, overall NC still recorded a respectable 13% growth.

Still aiming for FY16 target net profit of US$1b. Olam has made cumulative capex of

S$4.4b thus far, and has already committed another S$1.7b, the bulk of which will be utilised in FY13 & FY14. Olam plans to achieve its FY16 target US$1b PAT without raising fresh equity. Olam will use the debt capital market to source for funding for its investments. Olam’s lower gearing also provides scope for more debt to drive its acquisitions.

Other key highlights Biological gains were S$46m ahead of our expectation. The bulk of the gains were operational in nature ie due to crops maturity and yield improvement over time. The non-operational component, which is attributed to changes in crop prices and discount rates, is small.

Costs spiked up YoY in 4QFY12, which management attributed to 1) new businesses such as palm, rubber and fertilisers (which are not contributing to revenue as yet), 2) acquisitions which have yet to realise their full earnings potential, and 3) higher inflation rates in some countries that they operate.

Taking a longer term perspective, NC expanded a 3-year CAGR of 32%, with the three food segments each achieving between 36% & 40%. The weakness came from industrial raw materials, which still managed a mild 6% CAGR. We believe Olam is able to maintain its growth trend for the three food segments, and this will drive earnings growth over the next few years.

Balance sheet strength has improved. Net debt to equity of 1.81x is an improvement from Jun 11's 2.22x. Adjusted for RMIs and secured debtors, adjusted net gearing is a much lower 0.37x.

Wood and cotton seen to remain soft. Management guided that the global economic weakness could lead to continued softness for the industrial raw materials segment, although they saw some growth in the months of Jul and Aug. We assume this segment will remain weak in the months ahead.

No comments:

Post a Comment