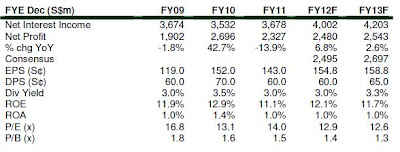

Only one amongst peers with sequential net profit growth. UOB recorded 2Q12 net profit of S$713m, up 3.6% QoQ. This is above market expectations of S$627m. The improvement is attributed to stronger fee & commission income offsetting (1) weakness in trading income; and (2) lower gains from sale of investments. Though NIM of 1.92% was 6 bps narrower QoQ, net interest income contracted a mild 1.7% QoQ as loans expanded marginally. UOB is the only bank amongst the three to record a sequential growth in net profit. We raised our FY12F net profit by 6% to S$2.48b primarily due to a lowering of provisions expectations. UOB remains our top pick and we maintain BUY. Target price is raised to S$21.40 based on 1.5x 2012 book (previously 1.4x), a discount to the 1.57x historical average.

NIM was squeezed, just like peers. NIM of 1.92% was 6 bps narrower QoQ due to high liquidity and keen market competition. UOB experienced NIM squeeze in markets such as Singapore and HK, whilst other regional markets recorded NIM stabilization. All the three banks’ recorded sequential NIM contraction. UOB management expects NIM to remain tight going forward. Management is guiding for high single-digit loan growth for FY12. We cut our FY12F loan growth to 9%, from 11% previously.

The bright spark is fee & commission income, which rose 6.7% QoQ, mainly driven by

investment related income (+16.7% QoQ) and loan-related fees (+9.5%). Management indicated that for corporate loans, the margins are fine but UOB is able to compensate by charging loan-related fees.

UOB declared an interim dividend of 20S¢ per share. The scrip dividend scheme will not be applied. UOB also announced that Hsieh Fu Hua will succeed Wee Cho Yaw as UOB Chairman effective Apr 2013.

Other Key Highlights

NIM was squeezed. NIM of 1.92% was 6 bps narrower QoQ due to high liquidity and keen market competition. UOB experienced NIM squeeze in markets such as Singapore and HK, whilst other regional markets recorded NIM stabilization. Management said UOB did not compete for high-cost deposits, which cushioned the NIM squeeze, though this led to a 2.3% QoQ decline in S$ deposits. All the three banks’ recorded sequential NIM contraction. UOB management expects NIM to remain tight going forward. We forecast FY12 NIM of 1.93%.

Management guiding for high single-digit FY12 loan growth. Loans expanded 1.4% QoQ, following 1Q12’s 2.6%. Singapore loans grew 1.3% QoQ whilst regional loans expanded a faster 3.0%. Worthy of mention is general commerce loans 4.7% QoQ expansion. Management is guiding for high singledigit loan growth for FY12. We cut our FY12F loan growth to 9%, from 11% previously.

Loan deposit ratio of 87.1% offers scope for further loan growth. UOB kept its USD loan deposit ratio at a low 95.2%.

Fee & commission income rose 6.7% QoQ, mainly driven by investment related income (+16.7% QoQ) and loan-related fees (+9.5%). Management indicated that for corporate loans, the margins are fine but UOB is able to compensate by charging loan-related fees.

As expected, trading income was weak, plunging 78% QoQ to S$11m. Nontrading income from sale of AFS also fell 16.4% QoQ to S$131m. After the jump in 1Q12, all three banks recorded weakness in these trading-related segments.

Despite UOB’s share price outperformance versus peers YTD, we expect further share price upside, on the back of UOB’s strong 2Q12 earnings from the fee & commission business, and its balance sheet robustness.

No comments:

Post a Comment