News and information of Singapore stock market. Chart with Support and Resistance. A blog to force myself to learn.

Dec 7, 2012

SIA No Virgin at Special Dividends

A big deal? Singapore Airlines (SIA) announced recently that they are looking to divest their 49% stake in Virgin Atlantic (VA), an investment they made for GBP600m some thirteen years ago. While the news itself wasn’t a big surprise, it was intriguing to see a wide range of offer prices quoted by news publications, from SGD200m (The Business Times) to ~USD1.2b (Bloomberg, CNBC). Both quoted Delta as the alleged interested party. Our take: fair value is likely to be closer to SGD1b, and this could result in an attractive special dividend.

One man’s meat, another’s poison. SIA’s investment in VA has been undermined by Richard Branson’s unwillingness to accede control of the airline to SIA, as well as the inking of a Singapore-UK agreement allowing SIA to fly the trans-Atlantic route from Britain. This trans-Atlantic route and prized landing slots at London’s Heathrow are exactly what Delta is after: a lucrative market for premium passengers.

Our view on Virgin’s worth: ~SGD1b. We did a simple comparison with International Airlines Group (IAG), parent of British Airways, Iberia and BMI, to make an educated guess on a fair value for VA’s business.

Sale could result in 8% special dividend yield. SIA has a much-vaunted net cash pile of close to SGD4b, which likely means any significant cash proceeds from a VA sale could be distributed to shareholders via a special dividend. SGD1b in cash proceeds would translate to ~SGD0.85 / share, or a potential 8% yield. Fundamentally, our HOLD call on SIA is maintained, still premised on a neutral outlook for the aviation sector. But things could start to look interesting for SIA.

Potential special dividend if cash sale goes through. Our VA valuation suggests an attractive special dividend should a cash sale be sealed. We do list two criteria for investors to watch for: confirmation of the transaction which is in-line or even exceeding our SGD1b estimates, and for the deal to be paid in cash.

Who blinks first: Delta vs SIA

Delta versus SIA. Final transaction prices in acquisitions stem largely from the bargaining positions of the buyer and seller: in this case, how badly Delta need the Virgin stake versus how badly SIA needs to divest it. We dug a little deeper to attempt to uncover Delta’s motivations behind their purported move for Virgin. Market reports seem to suggest that Delta is disciplined enough not to overpay for acquisitions such as this.

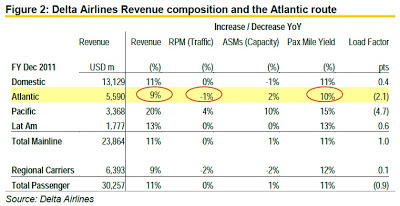

Boosting the Atlantic route. Based on Delta Airlines’ Dec 2011 financials (Fig 2), it seems the Atlantic route has been underperforming versus the rest of its passenger routes, with only single-digit revenue YoY gains, lowest yields, and negative RPM growth. What better way to improve the Atlantic route situation than to acquire Virgin Atlantic, which can claim to have the second-largest proportion of passenger traffic at Heathrow airport.

Heating up in Heathrow. Delta’s rationale for an acquisition of Virgin is further supported by its competitors’ presence in Heathrow. United Airlines already has a strong presence, while American Airlines has a joint venture with British Airways, the single largest airline at Heathrow (~40% of traffic). The New York-London route has been reported to be especially important for Delta because the single largest destination from Heathrow is the JFK airport (New York), where Delta has a hub and is further investing in its facilities there.

Only if the price is right. Our analysis seems to suggest that this sale of Virgin from SIA to Delta is almost a no-brainer given the fit with Delta’s requirements and SIA’s willingness to let go of an underperforming acquisition. However the biggest uncertainty remains the price. With Delta’s supposed reputation for discipline in acquisitions, and SIA not completely desperate to sell, all this hype could still end in nothing. After all, SIA has been known to have held talks on this exact same deal with different airlines in the past several years to no avail.

Special Dividend: what needs to happen. We conclude that while many unknowns still exist, there would be certain events to look out for which would help investors better navigate the likelihood of a special dividend:

(1) The transacted price needs to be significant enough versus existing net cash pile of SIA (~SGD3.8b). We think a SGD1b price would meet this criteria, and assert that without the Virgin sale, SIA would unlikely distribute a special dividend given that they actually cut their 1HFY3/13 interim dividend by 40%.

(2) The transaction needs to be paid in cash. We cannot rule out a share-swap as part of the deal, and obviously this would not be supportive towards the case of a special dividend.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment