■ What's new

We see little in Keppel REIT’s

(KREIT) briefing for its 4Q12 results

announced post-market on 21

January that justifies the recent runup

in its unit price.

■ What's the impact

The 4Q12 distribution-per-unit

(DPU) of 1.97¢ was 1% below our

forecast, while the major operating

line items were in line.

There was a marginal QoQ increase

in the Singapore occupancy rate

(98.5% vs. 98%) and the overall

occupancy rate, including at its

properties in Australia (98.5% vs.

98.2%). In Singapore, 80% of the

leasing take-up came from new

tenants (with the rest from existing

tenants). At Ocean Financial Centre

(OFC), the occupancy improved

slightly QoQ to 95.9% from 95%,

and the only spaces available are the

5th floor and half of the 42nd floor.

KREIT enjoyed another strong 4Q12

revaluation gain of

SGD217m, on higher valuations for its major

Singapore properties (cap rates

remained at about 4%, but rental

assumptions rose, according to

management). KREIT’s NAV

increased QoQ to SGD1.32 from

SGD1.25. Its aggregate leverage

(including those of its associates) fell

slightly QoQ to 42.9% (from 44.1%),

due to 4Q12 refinancing and the

revaluation gain. Management was

comfortable with the current gearing

level and highlighted KREIT’s healthy

interest coverage ratio of 4.8x.

Management also gave us the

impression that it was in no hurry to

acquire its sponsor’s stake in Marina

Bay Financial Centre (MBFC) Tower 3

and the deal might not occur in 2013.

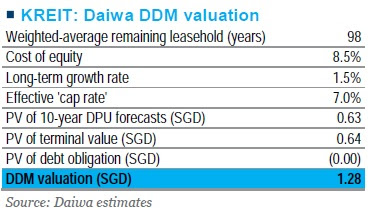

We make minor changes to our DPU

forecasts. We raise our six-month

target price, pegged to parity with

our 10-year DDM valuation, to

SGD1.28 (from SGD1.26), after

rolling forward our 10-year horizon

to 2013-22E (inclusive of a terminalvalue

estimate).

■ What we recommend

We downgrade our rating on KREIT

to Underperform (4) from

Outperform (2), after its recent strong

unit-price rise (from about December

2012), and given no material change

(from mid-October 2012) in the

Singapore office sector’s fundamentals.

KREIT now trades at what we regard

as demanding valuations (at a 5%

premium to its NAV as at 31

December 2012 of SGD1.32, the

highest in the office sector) for an office S-REIT. With a slight rise in its

core average property value of

SGD2,472/sq ft for 2012, when office

rentals declined by about 10% YoY, we

would regard any unit-price premium

to KREIT’s NAV with caution. The

major risk would be further acrossthe-

board yield compression in the SREIT

sector.

■ How we differ

Our DPU forecasts are still

significantly higher than those of the

Bloomberg consensus, as we expect

One Raffles Quay to remain resilient

in 2013, but we still believe KREIT’s

valuations are unattractive.

No comments:

Post a Comment